Reporting Residential Property Sale to HMRC

Selling a Residential Property and reporting the Sale to HMRC

In the Budget the Chancellor extended the period for Zero stamp duty on property purchases up to £500,000 until the 30th June 2021. After this date the zero threshold will reduce to £250,000 up to the 30th September 2021 and then drop down to £125,000.

This is great news for buyers and a further boost to the housing market.

Please remember that if you are buying a second property then the additional stamp duty still applies at a 3% surcharge.

Property bought in a company however will benefit from the new rates up to the 30th June 2021 provided the property is under the £500,000 limit.

Ask us for advice on this aspect if you are looking to buy a residential property.

What if you are a seller?

As a seller this should increase your chances of selling your property but beware if the property is not your main residence and you have potential capital gains tax to pay you must report the sale within 30 days to HMRC.

This new legislation came in for disposals after 6th April 2020.

When do I have Capital Gains Tax To Pay?

If the property is your main home, then you will not have to pay capital gains tax as it qualifies for Principle Property Relief.

If however you own another residential property perhaps you have bought a holiday home that just the family uses, you have bought a property for your children to live in whilst at university or you have residential property that you let out, then the new legislation may apply to you.

Capital Gains Tax is calculated based on the price you sell the property for after allowing for the price you paid for the property less other deductible costs.

Will It Apply to Me?

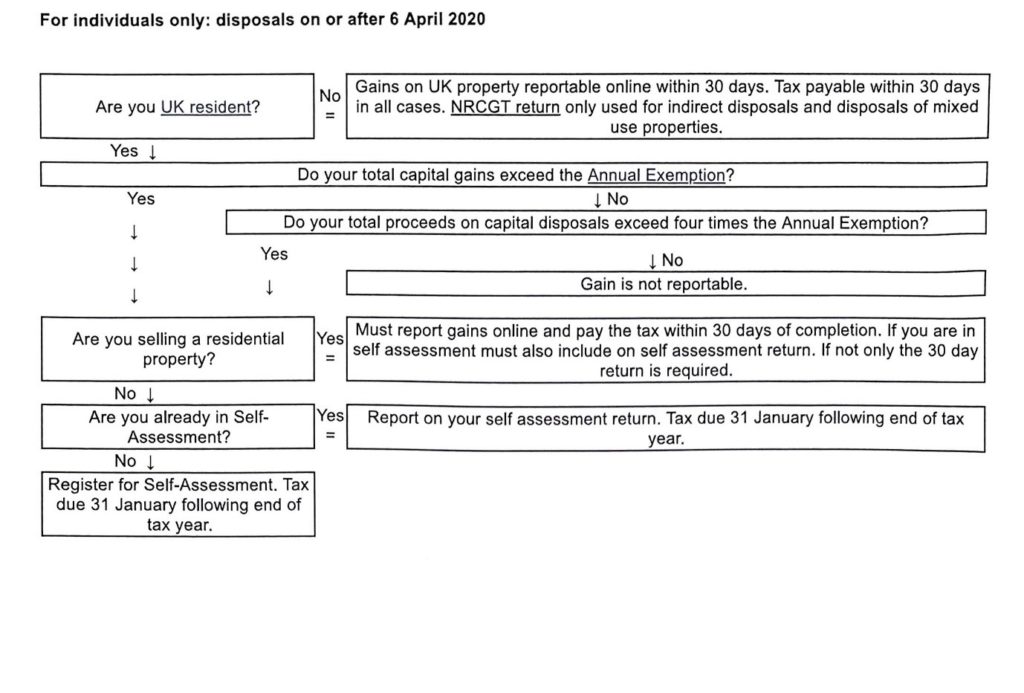

The flow chart below is a simple guide as to whether you will have to report the sale to HMRC.

What to Do to report the Gain

What to Do to report the Gain

Step One

Work out if you have any capital gains tax to pay on the property. To do this you will need the following information:

- calculations for each capital gain or loss you report

- details of how much you bought and sold the asset for

- the dates when you took ownership and disposed of the asset

- any other relevant details, such as the costs of disposing of the asset and any tax reliefs you’re entitled to

If you have a gain then move on to :

Step Two

Create a Capital gains Tax Gateway account with HMRC if you do not already have one

Step Three

Log into the gateway and report your gain

This must be done within 30 days of the property disposal date.

Step Four

HMRC will send you a letter advising you what you owe and giving you a reference number and details of how to pay

Do I have to do anything else?

Yes, if you complete a self-assessment tax return the gain details should also be recorded on to this return as part of your normal self-assessment completion.

Don’t wait until the deadlines for your self-assessment return as you may then face interest on the capital gains tax due.

This is a complicated area of tax law and if you need any advice on this we can assist and complete the calculations and the returns on your behalf.

We can provide a quote for this work to be done for you – Obtain Quote Now

For further information contact info@mcgintydemack.co.uk or call 0800 1223 633

We are here to help you.

What to Do to report the Gain

What to Do to report the Gain